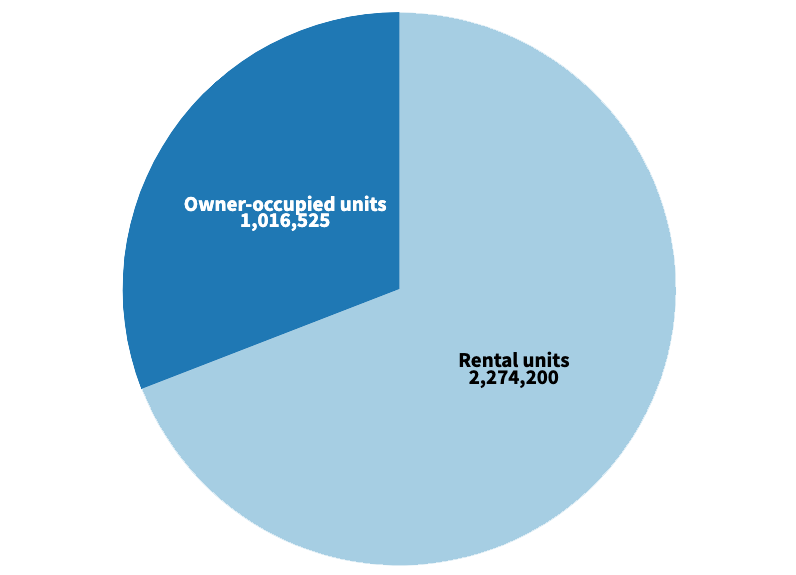

According to US Census data, the NYC population was estimated at approximately 8,467,513 people for 2021 while the number of housing units totaled 3,644,000. Of these units (Fig. 1), 2,274,200 (or 62%) were rentals while 1,016,525 (28%) were owner-occupied.

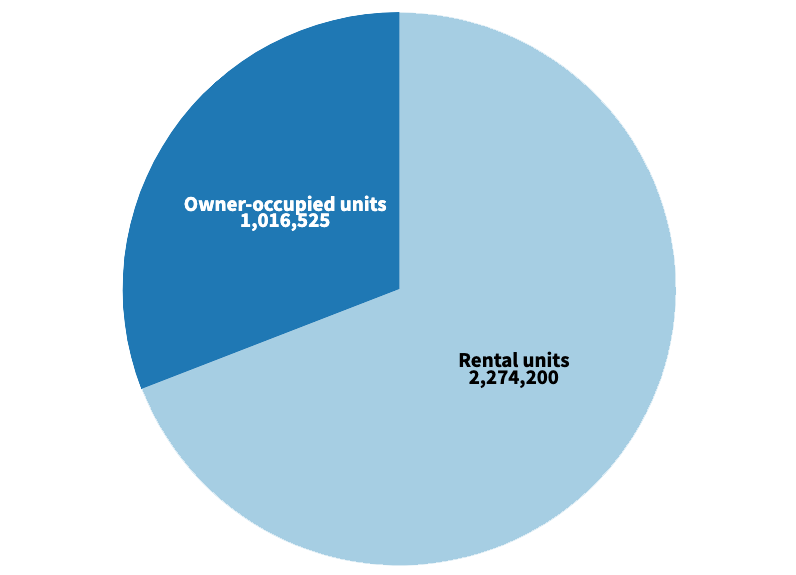

Rental prices in the NYC area have become so exorbitant that, currently, it actually has the highest rent prices in the US. According to StreetEasy (Fig. 2), by December 2022, the median asking rent for each of the five boroughs stood at:

Meanwhile, according to the Census Bureau, the NYC median household income stood at $70,663 for 2021 (according to the American Community Survey (ACS) 5-Year Estimates in 2021 dollars). If we were to follow the long-standing rule in academic circles that a household should spend no more than 30% of its income on housing costs, that would mean that no one in NYC should have spent more than an average of approximately $1,766 for rent in 2021.

Once a household must spend more than 30% of their income on housing, it is considered "rent burdened." New York City, unsurprisingly, is currently the most rent-burdened city in the US. According to Moody's Analytics, a NYC household would have to pay almost 69% of their median household income to rent an averaged-priced apartment.

In NYC, "affordable housing" refers to both rental apartments and homeownership opportunities that are accessible only if a resident's income falls between 0 and 165% of something called "Area Median Income" (or AMI). AMI is determined every year by the Department of Housing and Urban Development (HUD). (However, HUD does not use the term "Area Median Income," but rather "Median Family Income," which it then uses to calculate "income limits" for various housing programs.)

However, using AMI as the basis for deciding who gets access to "affordable housing" is a hotly contested issue.

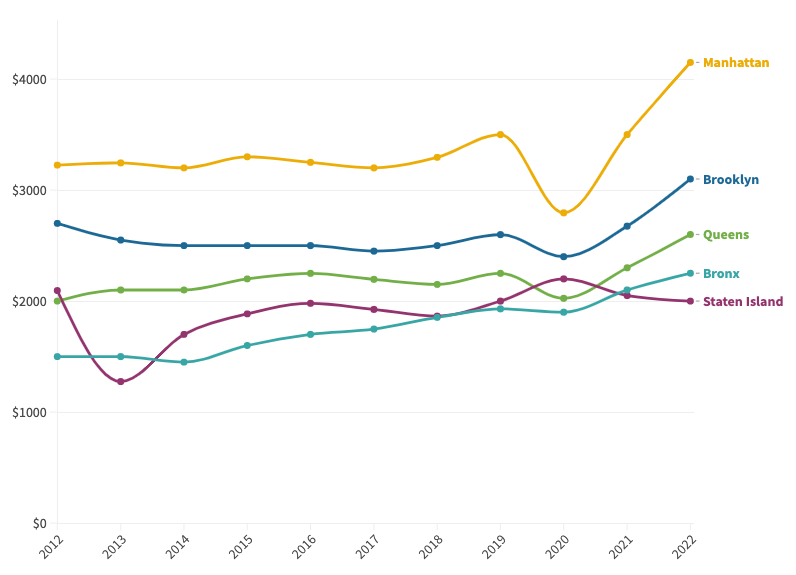

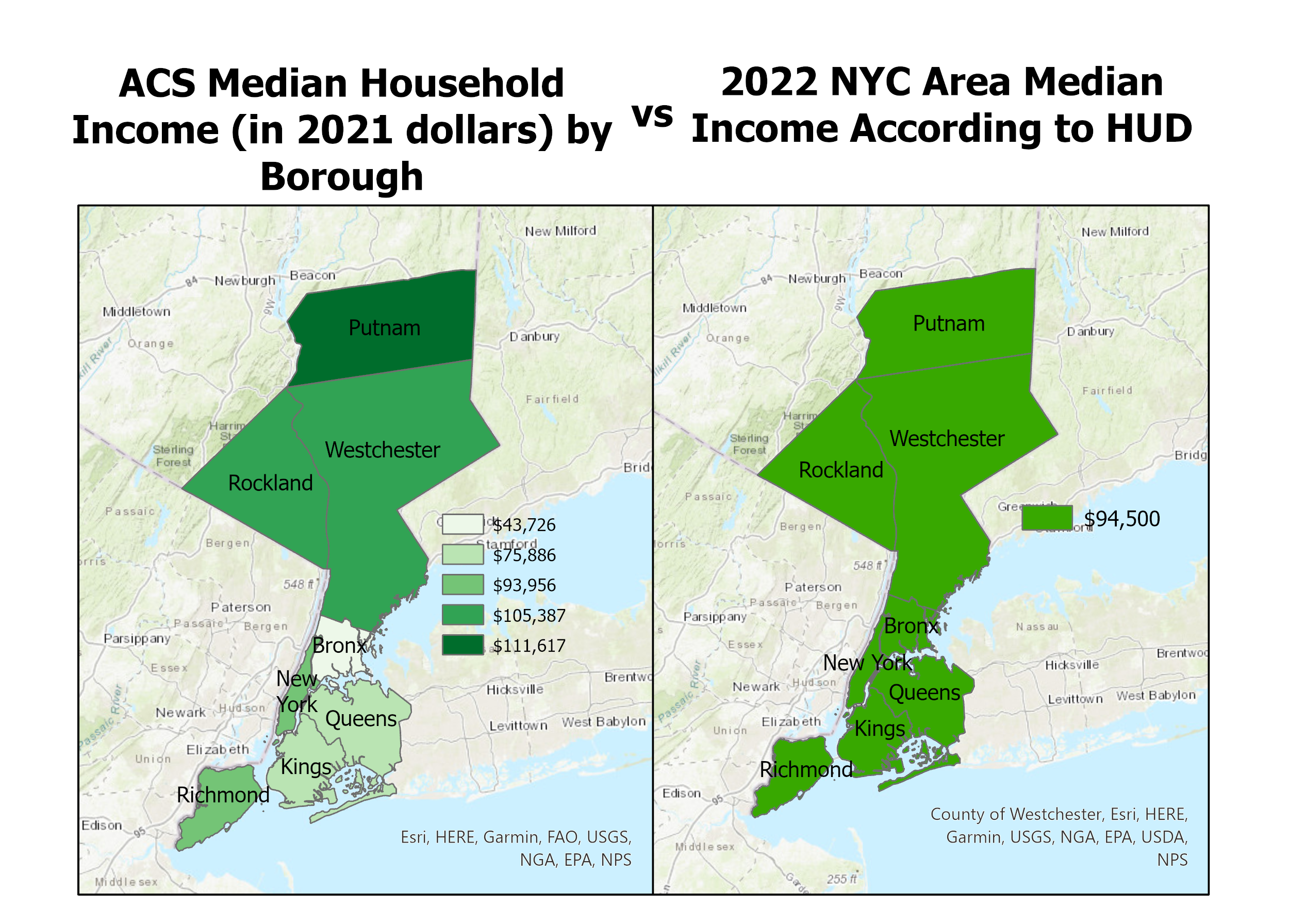

Activists point out several flaws with the way in which AMI is currently calculated. The Office of the Public Advocate, the NYC Independent Budget Office, and the Association for Neighborhood and Housing Development all point out that to calculate the NYC area median income, HUD includes the median incomes of not just the five counties of the five boroughs but also the three additional counties of Putnam, Rockland, and Westchester.

As can be seen in the visualization above (Fig. 3), when one looks at the US Census American Community Survey (ACS) Median Household Income figures by borough, one can empathize with critics' frustration over HUD's blanket figure that the NYC Area Median Income stands at $94,500 for a 3-person household. According to the Office of the Public Advocate, as a result of this calculation, “Extremely low and low income New Yorkers still have trouble accessing affordable housing.”

In NYC, “affordable housing” is a complicated hodge-podge of systems that can largely be broken down to:

1) New York City Housing Authority (NYCHA) - Founded in 1934 to try to fix the shoddy tenements during the Great Depression, today NYCHA comprises about 335 buildings in approximately 178,000 apartments, housing around 350,000 residents across the city.To view map legend, please click on the ![]() icon.

icon.